START MY

FUNDING APPLICATION

Purchase Order Funding for

South African Businesses

Solve Cash Flow Problems with PO Funding

Get the working capital you need to fulfil any purchase orders and grow your business.

If your business struggles with cash flow due to large orders, purchase order funding is the solution. Unahina Solutions provides up to 100% funding for your purchase orders, helping you fulfil your orders without financial stress and allowing you to grow your business.

What is Purchase Order Funding?

Purchase order funding (PO Funding), also known as purchase order finance, is a short-term financing solution that covers the cost of fulfilling large orders. It is designed to help businesses fulfil purchase orders without the need for a traditional bank loan.

How does PO Funding Work?

- If you have been awarded a purchase order but don’t have the cash flow to fulfil it.

- We will provide funding with a profit sharing model.

- You only pay us back when you get paid, no monthly instalments.

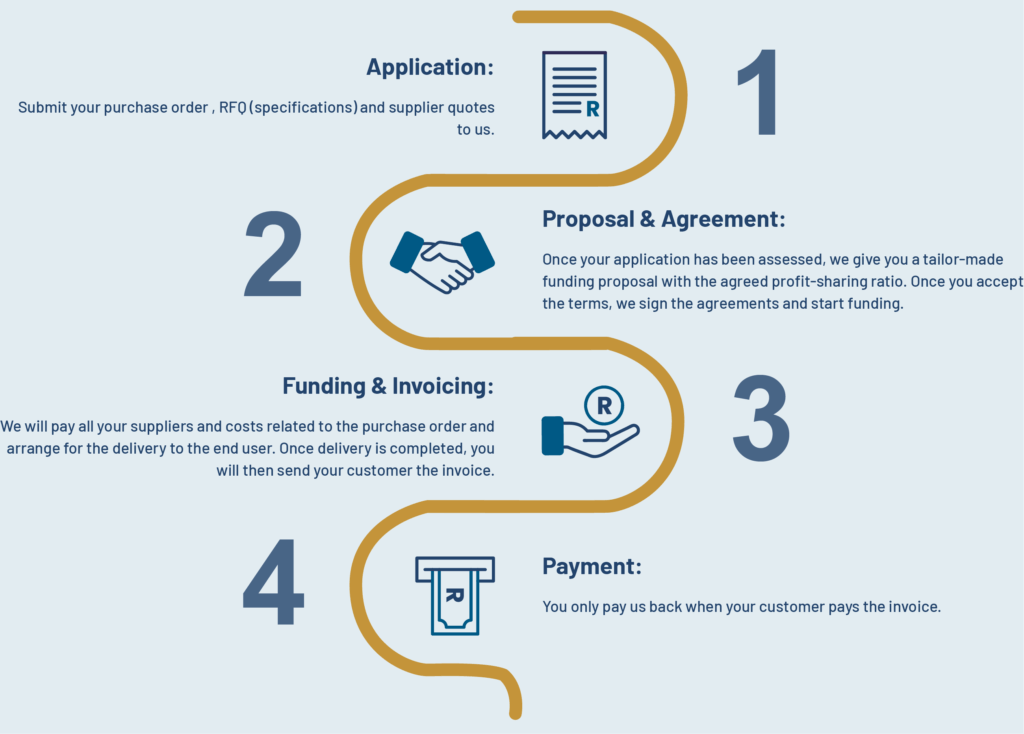

Unahina Business Solutions’ Simple Process

Purchase Order Finance is an ideal solution for small to medium enterprises (SMEs) and startup businesses in South Africa , especially when rapid sales growth puts pressure on cash flow. Instead of getting a traditional bank loan with monthly instalments, Purchase Order Finance gives you the capital to deliver on large orders without delays.

At Unahina Business Solutions, our application process is quick and easy. Let us tailor a funding proposal for you and get started with our simple four-step process.

4-Step Purchase Order Funding Process

Our 4-Step Purchase Order Funding Process

- Step 1: Application - Submit your purchase order, RFQ (specifications) and supplier quotes to us.

- Step 2: Proposal & Agreement - Once your application has been assessed, we give you a tailor-made funding proposal with the agreed profit-sharing ratio. Once you accept the terms, we sign the agreements and start funding.

- Step 3: Funding & Invoicing - We will pay all your suppliers and costs related to the purchase order and arrange for the delivery to the end user. Once delivery is completed, you will then send your customer the invoice.

- Step 4: Payment - You only pay us back when your customer pays the invoice.

Do You Qualify for PO Funding?

In order for your business to qualify it must:

- Have a registered company.

- Have a valid Purchase Order.

- Have reputable suppliers.

- Have a decent profit margin

Why Choose PO Funding?

- Leverage Growth Opportunities: Fulfil large orders and grow your business

- No Personal Guarantees needed: Unlike loans, no collateral is required

- Fast Approval: Get funded within 3 to 5 business days

- Hands-on support from our funding experts throughout the process

- Build your reputation with your customers

- No monthly instalments or hidden costs

- Only pay us back when you get paid

What You Need to Know About Purchase Order Finance

If you’ve already delivered the goods and issued an invoice, then Invoice Funding may be more suitable. But if you need capital before delivery, Purchase Order Finance is your solution.

What is Invoice Funding (Financing)?

Invoice financing is a way to access cash flow while you wait for payments from your end user (customer). With invoice financing, we give you a portion of the outstanding invoices upfront. This type of finance is particularly for businesses that have a 30 day to 90 day payment term with their clients and are struggling with clash flow due to the long payment terms.

PO Funding helps businesses like:

- SME’s with government supply chain orders

- Wholesalers & resellers

- Seasonal product businesses

- Distributors

Why Choose Unahina Business Solutions?

- Up to 100% PO Funding

- Fast Turnaround Time

- Fixed and Transparent profit-sharing model

- Business Coaching & Mentorship Included

We don’t only fund your orders, we support your business growth for long-term success.

Let's Look at Sophia's Journey to Purchase Order Funding

Frequently Asked Questions

Who Uses Purchase Order Funding (Financing)

If your customer places a large order and you don’t have the cash flow to pay your supplier immediately, then PO funding can help you fulfil that order in time

Businesses that may use this type of funding include:

- Resellers

- Wholesalers

- Distributors

- Outsource manufacturers

- Businesses with increased seasonal sales

- Businesses that cannot afford to fulfil a big order due to limited cash flow

If your business relies on external suppliers for products that you resell, you can benefit from PO funding. With the help of Purchase Order Finance, you can grow your business and onboard customers that you may not have been able to without the funding and expertise.

Keep in mind that if you have already delivered goods to a customer and invoiced them, then you should apply for invoice funding, not PO funding.

What are the Advantages of PO Funding?

- Fast access to working capital

- No monthly instalments

- No personal guarantees required

- Flexible and scalable with your growth

- Helps build supplier trust

What are the Disadvantages of PO Funding?

- PO funding is strictly a short-term solution and must be repaid when your client pays you.

- Profit sharing ratio may vary based on your agreement, size of the order, amount of funding needed and how long it will take to complete.

How Purchase Order Funders Make Their Money

To qualify, the profit margin on your purchase order has to be sufficient for the funding provider to consider it viable.